Read More

China Silver to raise HK$464 mln in discounted share placement

16-02-2026 17:14 HKT

Kerry Properties unit wins Hong Kong Shau Kei Wan site for HK$1.38 bln

16-02-2026 15:21 HKT

Gold drops over 1pc as thin trading, profit‑taking weigh

16-02-2026 14:48 HKT

Japan's economy limps back to scant growth in Q4, raises test for Takaichi

16-02-2026 11:14 HKT

Hong Kong shares dip ahead of Chinese New Year as holiday caution

16-02-2026 09:42 HKT

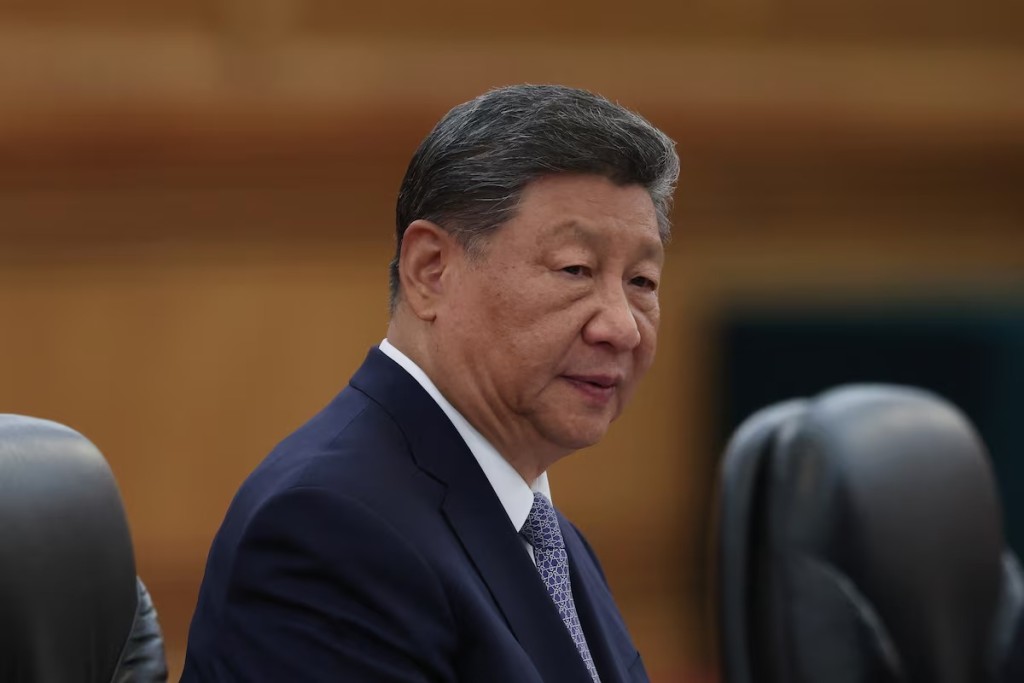

China's Xi calls for stronger domestic demand, innovation

15-02-2026 16:44 HKT