Read More

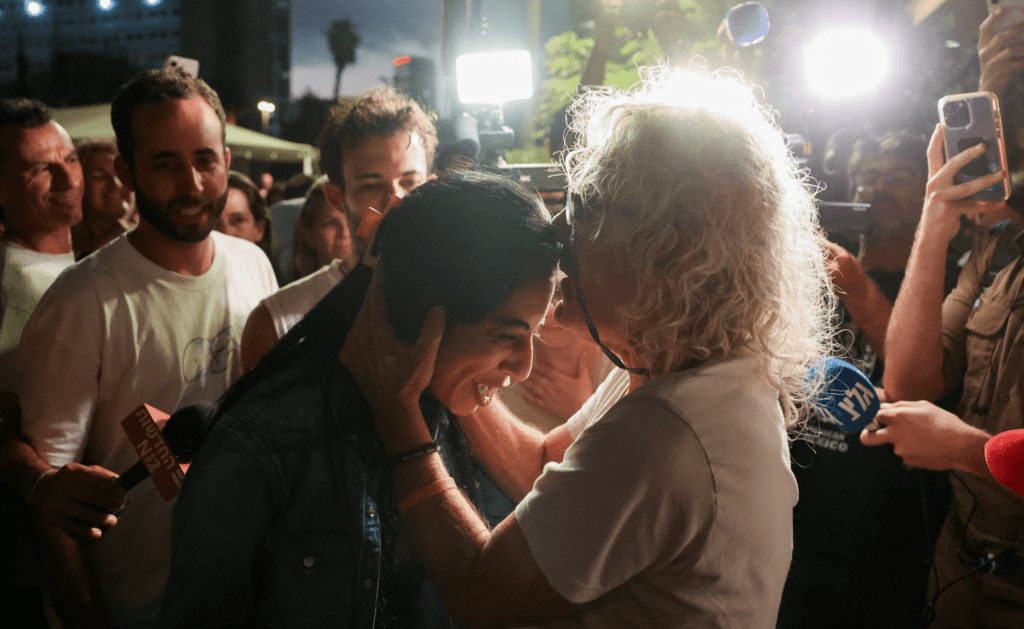

Israeli cabinet ratifies Gaza ceasefire and hostage deal with Hamas

10-10-2025 05:06 HKT

Middle-aged cyclist critically injured in Sheung Shui accident

06-10-2025 01:10 HKT

Tourist bus crash in Egypt kills 2 Chinese, injures 3

29-09-2025 23:28 HKT

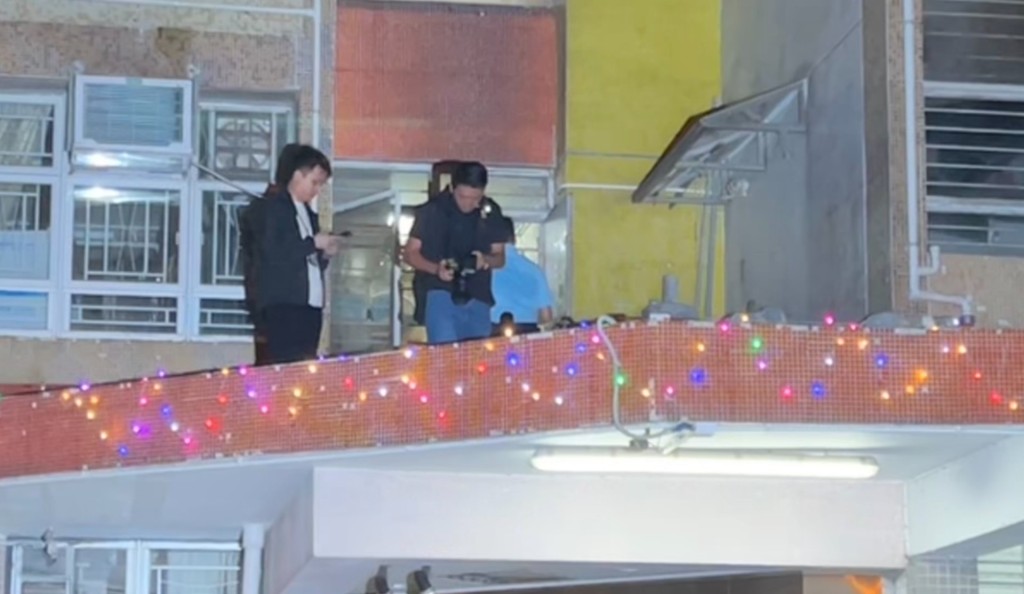

Tree falls near Sheung Shui MTR Station, injuring four pedestrians

22-09-2025 00:29 HKT

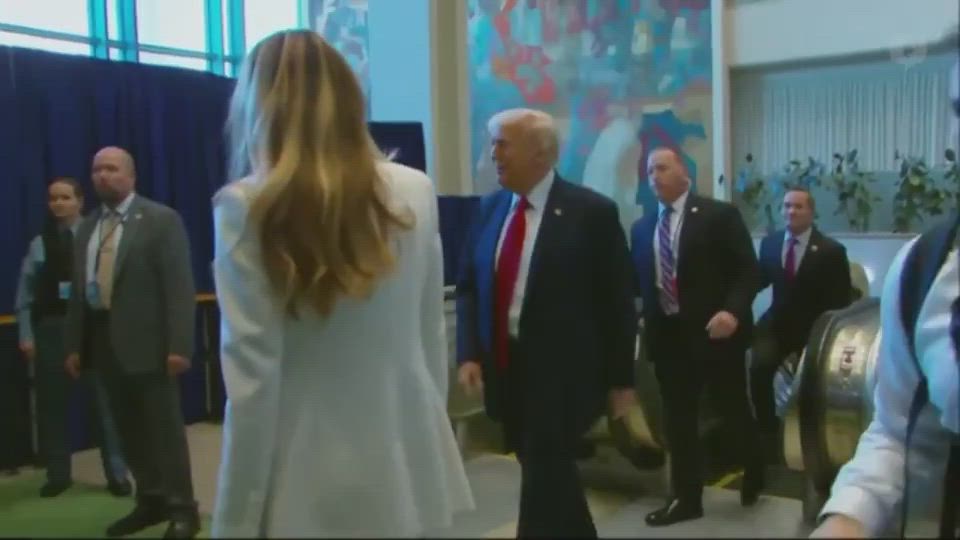

Morning Recap - September 19, 2025

19-09-2025 06:57 HKT

Relief at last? Cooler weather forecast for HK

12-10-2025 17:36 HKT