Read More

Wall St opens muted after record highs, on track for weekly gains

12-09-2025 21:39 HKT

160 Health IPO 504 times oversubscribed by retail

12-09-2025 17:07 HKT

Hong Kong shares ended the week by a 300-point rally

12-09-2025 16:37 HKT

Zijin Gold International readies up to US$3 bln Hong Kong IPO

12-09-2025 14:45 HKT

China stocks at new decade-high, HK shares hit 4-year peak on AI optimism

12-09-2025 12:48 HKT

Hong Kong stocks touched 26,500 level on Friday

12-09-2025 10:21 HKT

Wall Street indexes post record-high closes; Tesla and Micron rally

12-09-2025 05:38 HKT

US consumer prices increase more than expected in August

11-09-2025 22:34 HKT

Wall St opens higher after inflation data keeps rate cut bets firm

11-09-2025 21:39 HKT

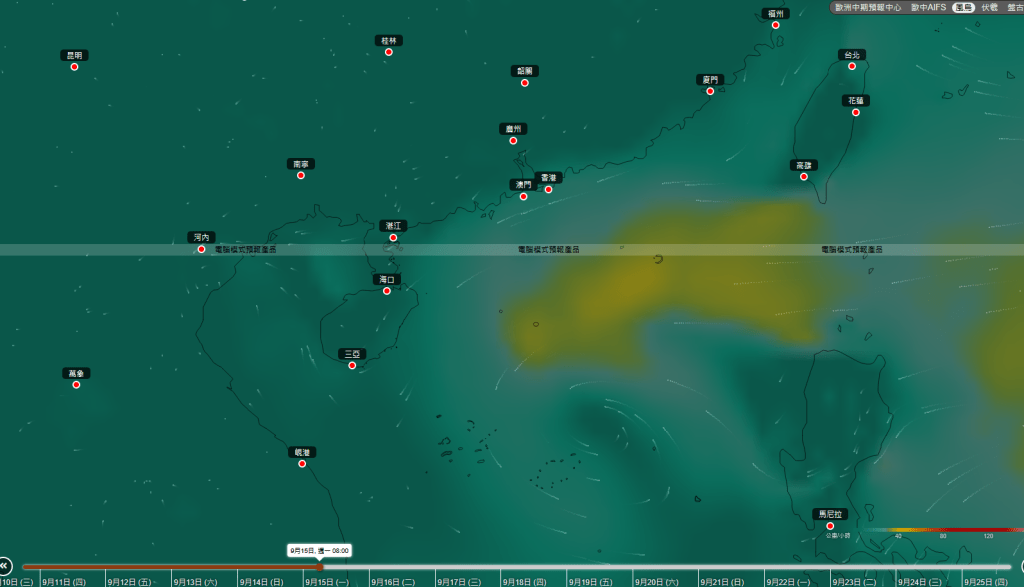

Tropical cyclone threat looms over HK as weather patterns shift

11-09-2025 15:00 HKT