Read More

Night Recap - December 6, 2025

04-12-2025 20:55 HKT

Night Recap - December 4, 2025

04-12-2025 20:55 HKT

Tai Po fire death toll rises to 128

28-11-2025 07:00 HKT

HK reports one new imported case of chikungunya fever in Kwai Tsing

20-11-2025 21:45 HKT

Mercury to dip to 14 degrees on Wed: Observatory

17-11-2025 13:18 HKT

US Senate passes bill to end government shutdown, sends to House

11-11-2025 10:39 HKT

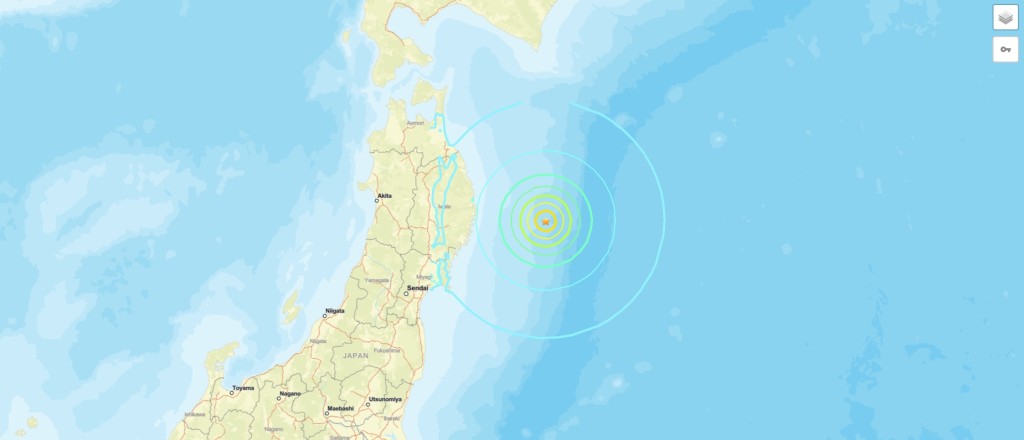

Japan issues tsunami advisory following 6.7 magnitude quake

09-11-2025 16:42 HKT

Sex video forces hospital to suspend top staff

06-11-2025 20:03 HKT